Introduction:

Get into our guide about Financial mastery in real estate ventures,where we delve into the financial aspects of the industry. Whether you’re a seasoned investor or just starting out, mastering the financial aspects of your investments is crucial for maximizing returns and minimizing risks. In this blog, we will provide insightful articles and resources on various topics related to financing, taxes, and accounting in the world of strategic investments.

Financing Strategies of Real Estate

- Exploring diverse financing options for strategic investments, including traditional loans, private lenders, and innovative financing techniques.

- Understanding the criteria and prerequisites for securing loans and financing, along with valuable tips to enhance your approval prospects.

- Evaluating the advantages and disadvantages of leveraging debt in strategic investing and calculating the potential return on investment.

- Exploring government-backed loans such as FHA, VA, or USDA loans.

- Understanding the eligibility criteria and benefits, particularly for first-time investors or those focusing on specific target areas.

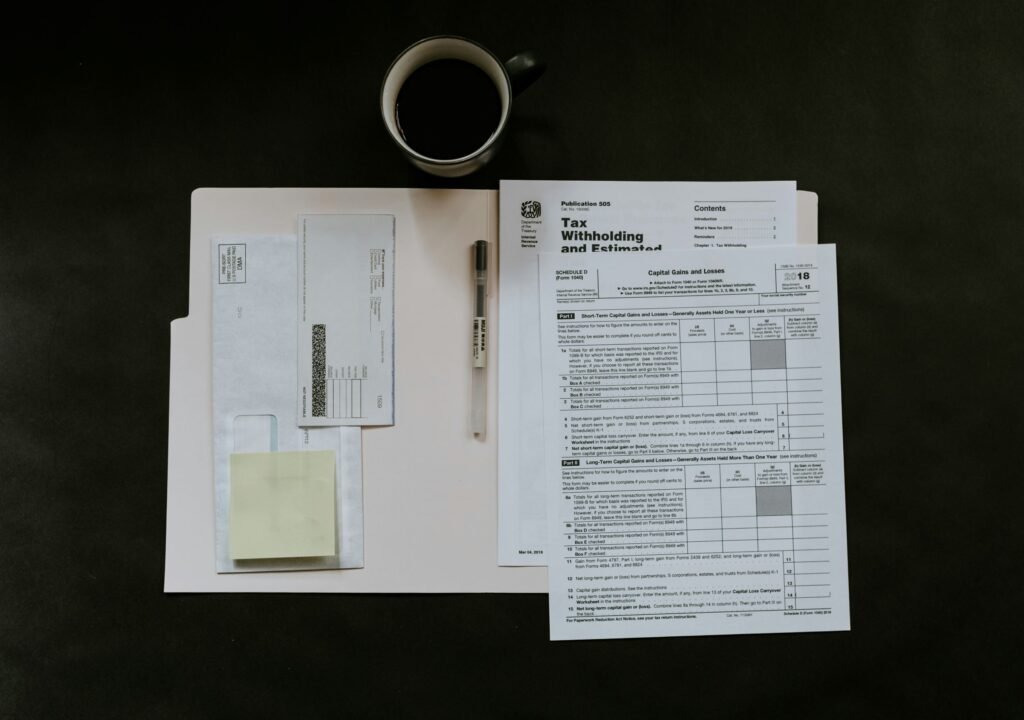

Tax Considerations

- Unraveling the complexities of real estate taxes, including property taxes, capital gains taxes, and depreciation deductions.

- Strategies for minimizing tax liabilities through proper tax planning, utilizing 1031 exchanges, and taking advantage of tax incentives and deductions.

- Navigating the tax implications of different investment strategies, such as fix-and-flip, rental properties, and real estate investment trusts (REITs).

- Understand the unique tax considerations associated with REITs. Explore the pass-through taxation structure and the implications for investors receiving dividends.

Risk Management and Insurance

- Examining insurance options for safeguarding strategic assets against property damage, liability claims, and other risks.

- Assessing risk factors in investments and implementing risk mitigation strategies.

- Understanding the role of inspections, due diligence, and proper insurance coverage in minimizing potential risks.

- Prioritize regular inspections and maintenance to identify potential risks early on. Addressing maintenance issues promptly contributes to risk prevention and asset value preservation.

Real Estate Investment Strategies

- Discussing various investment strategies, such as residential properties, commercial properties, multi-family units, and real estate development.

- Analyzing the financial implications of different investment strategies and identifying opportunities for diversification.

- Exploring investment models, such as buy-and-hold, fix-and-flip, and passive real estate investing.

- Consider entering joint ventures to pool resources and expertise. Explore how partnering with other investors or professionals can enhance the scope and success of real estate projects.

- Analyze the intricacies of distressed property investing, including foreclosures and short sales. Learn how to navigate challenges and capitalize on opportunities in the distressed real estate market.

Conclusion

Strategic investing is not just about finding the right asset; it’s also about mastering the financial aspects to ensure long-term success. By staying informed and educated on topics related to financing, taxes, and accounting, you can make informed decisions and optimize your investment portfolio. Follow our blog for regular updates, expert insights, and practical tips on navigating the financial side of strategic investing.