- September 10, 2025

GST 2.0: A Game-Changer in Making Indian Real Estate More Affordable

For millions of Indians, owning a home is one of life’s biggest goals. It’s not just about having four walls — it’s about stability, pride, and financial security. But rising construction costs, high taxes, and complicated rules often make this dream difficult.

That’s where tax reforms like the Goods and Services Tax (GST) come in. Ever since GST was launched in 2017, the real estate sector has been one of its most debated areas. While the intention was to simplify and bring transparency, the way GST applied to homebuyers and developers was not always smooth.

Now, with what is being called GST 2.0, the government has taken a big step to fix these gaps. The reforms focus on making construction materials cheaper, simplifying rules, and ultimately, reducing the price of apartments—especially under-construction ones.

So, is GST 2.0 really a game-changer? Let’s explore in detail.

1. A Quick Recap: Taxes on Apartments Before GST

Before GST was introduced, the tax structure for real estate was extremely complicated. Buyers had to pay multiple indirect taxes, often without clarity:

- – VAT (Value Added Tax): levied by state governments.

- – Service Tax: charged on construction-related services.

- – Excise Duty: applied to materials like cement, steel, paints.

- – Entry Tax/Octroi: levied when goods moved across state borders.

The problem?

- – Different states charged different VAT rates.

- – Buyers didn’t always know what portion of their money went into taxes.

- – Developers faced double taxation (tax on both materials and services).

Example: If you bought an under-construction apartment in 2016, you might have unknowingly paid taxes adding up to 10–15% of the property value, even before stamp duty and registration.

2. What Changed with GST in 2017

The Goods and Services Tax (GST) replaced most indirect taxes with one unified tax. This was meant to bring simplicity and transparency.

For real estate, GST applied mainly to:

- – Under-construction flats

- – Construction materials

- – Services like contractors, architects, plumbing, etc.

Ready-to-move-in flats remained exempt from GST.

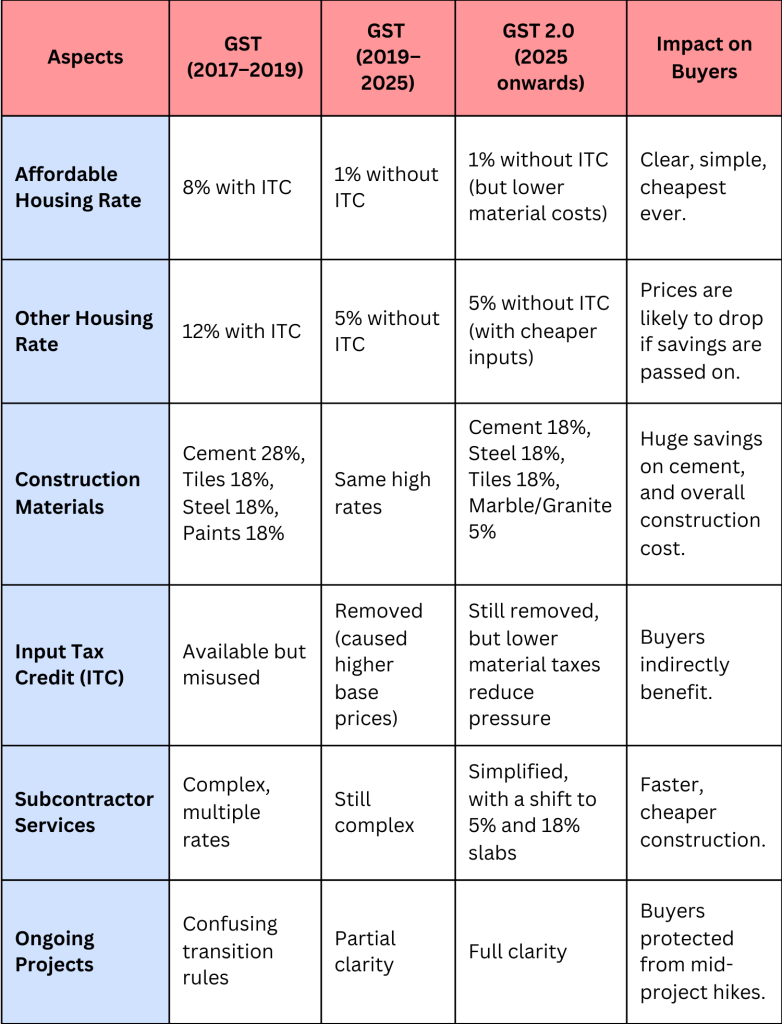

GST Rates for Housing (2017–2019)

- – Affordable Housing: 8% (with ITC)

- – Other Housing: 12% (with ITC)

This sounded good at first, because buyers could benefit from Input Tax Credit (ITC) — meaning builders could deduct the GST paid on raw materials from the GST they charged buyers.

But in reality:

- – Developers often didn’t pass ITC benefits to buyers.

- – Material GST rates were very high (cement at 28%, tiles at 18%, steel at 18%).

- – Confusion arose between states, developers, and buyers.

3. The First Big Reform in 2019

In April 2019, the GST Council made a major change to address complaints:

- – Affordable Housing: 1% GST (no ITC)

- – Other Housing: 5% GST (no ITC)

This made tax calculation easier — just 1% or 5% flat rate on apartment value.

But there was a trade-off: No Input Tax Credit.

This meant developers had to bear the high GST on materials without being able to offset it. The result? Many developers quietly added these costs into the base price of apartments. Buyers didn’t always see a big price drop.

4. Enter GST 2.0 — What's New?

In late 2025, the government launched the GST 2.0 reforms, specifically to fix the issues in real estate and other sectors. The changes, effective from September 22, 2025, are focused on:

Lowering GST on Construction Materials

- – Cement: Reduced from 28% → 18%

- – Steel: Remains same 18% (no change, but the shift from 28% on some finished goods to 18% is a major move under the new two-slab system)

- – Marble and Granite Blocks: Reduced from 12% → 5%

- – Paints: Remains same 18% (no change)

- This is a significant win for both developers and buyers, especially for materials like cement which saw a 10% rate reduction.

Simplifying Rates on Services

- – The GST Council has simplified the overall tax structure to a two-slab system (5% and 18%), with a special 40% rate for luxury and sin goods. This streamlines the classification of services, reducing confusion.

Clarity for Ongoing Projects

- – Rules for projects already under construction during the shift to GST 2.0 are clearly defined. No more sudden cost spikes mid-way.

Affordable Housing Push

- – The 1% GST rate for affordable housing continues, but with cheaper materials, the total cost for builders is lower than ever, which should translate to lower prices for buyers.

5. GST 1.0 vs GST 2.0: Side-by-Side Comparison

Here’s a detailed comparison:

6. Why Lower Material GST is a Big Deal

Construction material is the backbone of real estate costs:

- – Cement → 20–25% of cost

- – Steel → 15–20%

- – Tiles, paints, fittings → 10–15%

Earlier, with GST on cement at 28%, taxes formed a massive chunk. Developers had two options: absorb the tax (hurting profits), or pass it to buyers.

Example:

A 1,000 sq. ft. apartment requires about 300–350 bags of cement.

- – Earlier GST at 28% meant taxes of nearly ₹40,000–50,000 just on cement.

- – Now at 18%, this drops to ₹25,000–30,000.

That’s ₹15,000–20,000 saved per flat just from cement. Add other materials like marble and granite, and savings could be significant.

7. Who Benefits the Most?

- a) Affordable Housing Buyers: 1% GST + reduced material cost = lowest apartment cost in years. Government incentives like PMAY (Pradhan Mantri Awas Yojana) make it even better.

- b) Middle-Class Buyers: 5% GST remains, but since construction costs are lower, mid-segment apartments could see meaningful price drops. Competition among developers may force them to pass on savings.

- c) Developers: Lower taxes on inputs mean less pressure on margins. Easier compliance → fewer disputes with GST authorities. Faster project completion → more supply in the market.

- d) The Economy: Real estate drives 200+ allied industries (cement, steel, paints, tiles, transport). Lower GST boosts demand, creates jobs, and strengthens growth.

8. What Still Hasn't Changed

While GST 2.0 is a big improvement, some challenges remain:

- – Stamp Duty & Registration Fees: Still outside GST, charged separately by states (5–8%). These remain a big burden.

- – Land Costs: Land is not taxed under GST, but in cities, land often makes up 40–60% of apartment prices.

- – No ITC for Buyers: Without Input Tax Credit, buyers have no direct control over savings. They depend on developers passing on benefits.

- – Luxury Housing: High-end projects may not see big benefits, as some luxury materials and fittings may not be covered under the new GST cuts.

9. What Homebuyers Should Do

If you’re planning to buy a flat in the GST 2.0 era, here are a few tips:

- – Check the Project Stage: GST applies only to under-construction homes. Ready-to-move homes don’t attract GST.

- – Ask for a Cost Breakup: Ensure the builder explains material costs, GST, and base price separately.

- – Look for Competitive Pricing: In high-supply markets, developers may advertise “GST 2.0 savings” offers. Compare before deciding.

- – Negotiate Perks: Even if prices don’t drop, you can negotiate for waived parking fees, free modular kitchens, or maintenance holidays.

- – Stay Updated: Follow GST Council announcements — further tweaks may happen based on industry feedback.

10. Long-Term Outlook

GST 2.0 is more than just a tax change — it’s a confidence booster for the real estate market. By lowering costs, simplifying rules, and providing clarity, it can:

- – Make housing more affordable for first-time buyers.

- – Attract investors back to the property market.

- – Encourage developers to launch new projects with lower risk.

- – Support the government’s “Housing for All” mission.

If states also consider rationalizing stamp duty, the dream of affordable housing will move even closer to reality.

Conclusion

GST 2.0 is a significant upgrade over the earlier system. By cutting GST rates on key construction materials like cement, maintaining low housing tax rates, and simplifying compliance, it directly reduces the cost of building apartments.

For affordable housing, this is a massive win. For mid-segment buyers, savings will depend on how much developers pass on. For the real estate industry, it signals stability and growth.

At the end of the day, GST 2.0 is not just about tax numbers — it’s about making the Indian middle-class dream of home ownership more achievable.