- October 23, 2024

How to Improve CIBIL Score for Home Loans

A good CIBIL score can be the key to unlocking your dream home. For home buyers, a healthy credit score is essential as it plays a significant role in securing favorable loan terms. But what exactly is a CIBIL score, and how can you improve it to get the best home loan rates?

Let’s speak about everything from understanding CIBIL scores & tips to improve credit score through actionable tips on boosting your credit score for home loans. By following these tips, you can ensure a smoother path toward owning your dream home.

Understanding CIBIL Score: What is it and Why it Matters?

Your CIBIL score is a three-digit number ranging from 300 to 900 that reflects your creditworthiness. It is derived from your credit history and behavior, and lenders use it to assess your loan repayment capacity.

A higher score indicates lower risk, making it easier for borrowers to secure loans at favorable rates. For home buyers, understanding this score is crucial, as it can impact everything from the approval process to the interest rates offered.

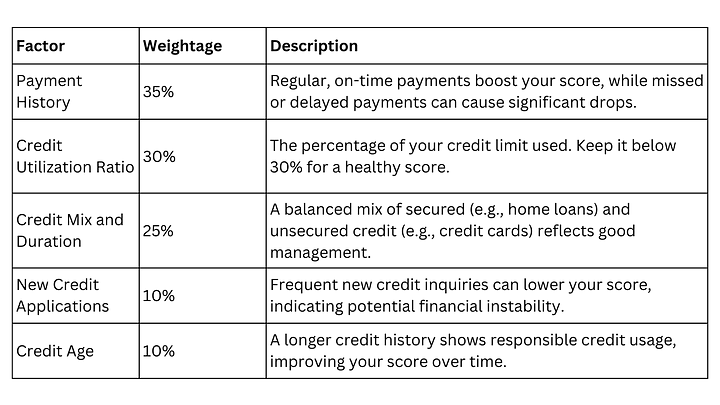

Factors That Affect Your CIBIL Score

Your CIBIL score is calculated based on multiple factors affecting cibil score that reflect your financial behavior and creditworthiness. Understanding these factors can help you make informed decisions to improve and maintain a healthy score. Here are the key elements:

Each of these factors plays a role in determining your overall score. Improving even one area can boost your credit score over time, helping you achieve a healthier financial profile.

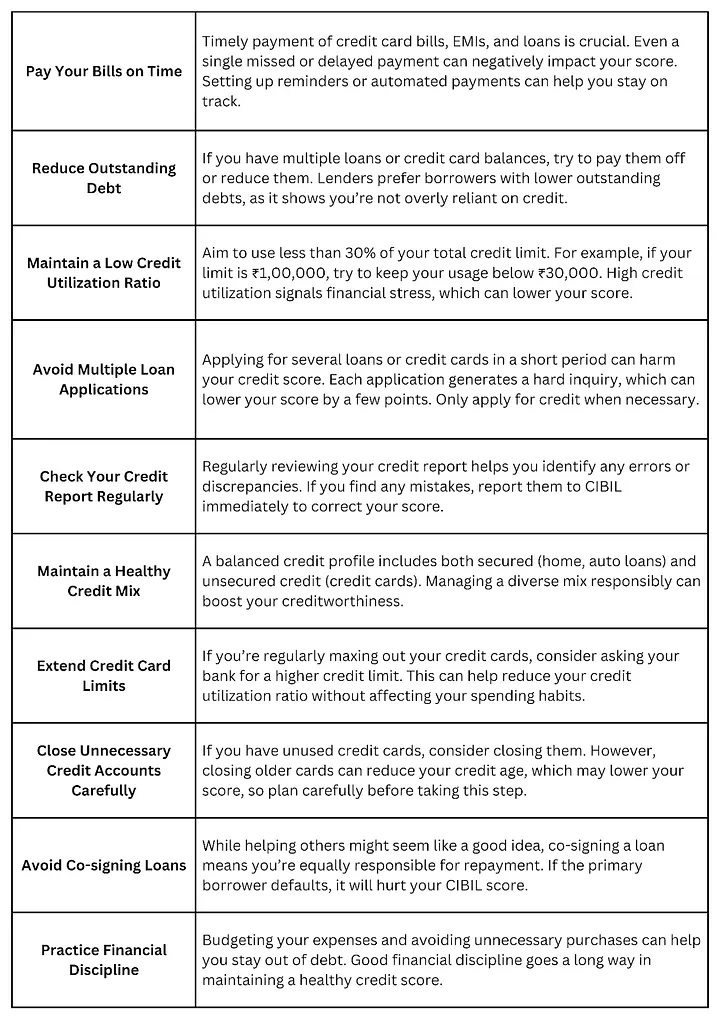

Steps to Improve Credit Score

Improving your CIBIL score requires consistent effort and strategic planning. Effective credit score improvement requires consistent effort, including timely payments and reducing outstanding balances.

Here are some effective steps you can take:

These tips to improve credit score, when consistently followed, can help improve your CIBIL score over time, making you eligible for better loan options and interest rates.

The Role of Financial Discipline to Improve Cibil Score

Financial discipline is the foundation for a strong credit score. Budgeting helps manage your expenses, ensuring you have enough to meet your obligations without delay. Setting up automatic payments for your bills can prevent missed payments, while cutting back on unnecessary expenses ensures more cash flow to pay off debts.

Common Mistakes to Avoid While Boosting Credit Score

When working to improve your CIBIL score, it’s essential to be aware of common mistakes that can hinder your progress. To increase CIBIL score, avoid late payments, maintain a low credit utilization ratio, and diversify your credit mix.

Here are some pitfalls to avoid:

1. Skipping or Delaying Payments: Missing a payment, even by a few days, can cause a dip in your score. Improve CIBIL score by maintaining timely payments and reducing outstanding debts. Setting up automatic payments can help this.

2. Maxing Out Credit Cards: Consistently using the maximum limit on your credit cards leads to a high credit utilization ratio, which can negatively affect your score. Try to keep usage under 30%.

3. Applying for Multiple Loans or Credit Cards Simultaneously: Each application triggers a hard inquiry on your credit report, which can lower your score. Limit applications and space them out over time.

4. Ignoring Your Credit Report: Errors or discrepancies in your credit report can bring down your score. Regularly check your report and dispute any inaccuracies.

5. Closing Old Credit Accounts Too Soon: While it might seem smart to close unused accounts, closing older credit lines can shorten your credit history, which may reduce your score. Keep older, well-managed accounts open.

6. Overlooking the Importance of a Credit Mix: Having only unsecured credit (like personal loans or credit cards) can limit your score. Consider maintaining a balanced mix of secured (home, car loans) and unsecured credit.

7. Taking on Too Much Debt at Once: Accumulating multiple debts, even if you can manage them, makes you look riskier to lenders. Prioritize paying off existing debts before taking on new loans.

8. Neglecting Loan Prepayments: If you have extra funds, consider prepaying loans to reduce outstanding debts. However, some may forget this option, which could lead to a longer debt period and higher interest payments.

9. Avoiding these common mistakes can be the prominent tips to improve credit score & it will help you build and sustain a healthy CIBIL score, ultimately making it easier to secure home loans and other credit facilities on favorable terms.

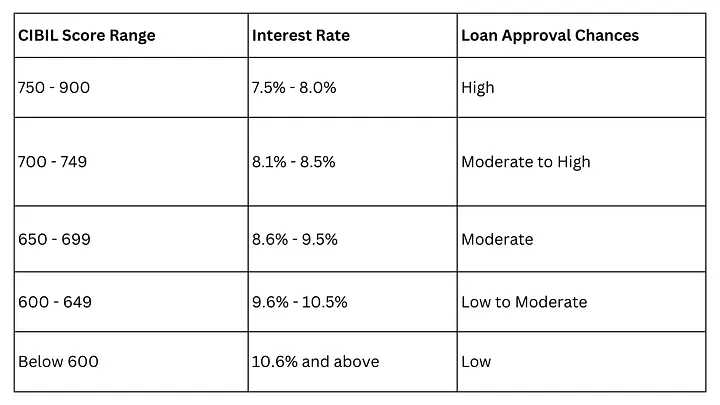

Analytics: How CIBIL Scores Impact Loan Interest Rates?

A higher CIBIL score typically means lower interest rates, saving you significant money over the life of a home loan. The minimum CIBIL score for home loan approval typically starts at 650, but a higher score can secure better rates.

Here’s a comparison of how different CIBIL score ranges can affect home loan interest rates:

As illustrated, applicants with an ideal CIBIL score above 750 enjoy lower interest rates, resulting in significant savings over the loan term. For example, someone with a score of 800 can save around ₹2 lakhs over a 20-year loan compared to someone with a score of 650.

How Long Does It Take to Improve CIBIL Score?

Improving your CIBIL score is not an overnight process. Depending on the steps you take, it can take anywhere from 3 to 12 months. For example, if you correct inaccuracies in your report, you might see an improvement within a month. A good home loan CIBIL score ensures favorable loan terms and a smoother approval process.

However, paying down significant debts or establishing a longer credit history could take longer.

Benefits of a Good CIBIL Score Beyond Home Loans

A high CIBIL score can open up several opportunities beyond home loans. You might be eligible for personal loans, credit cards with better benefits, and even car loans at competitive rates. Moreover, it shows financial stability, which can be advantageous for potential investments and financial planning.

To know how to get a better home loan rate, focus on improving your CIBIL score and maintaining a strong credit profile.

Why Maintaining a Good CIBIL Score is Essential for Home Loan Applicants?

Maintaining a strong CIBIL score ensures faster loan approvals and higher loan amounts, which is particularly useful when purchasing homes in cosmopolitan townships like Morais City. With a good credit score, you can negotiate for better terms, making your home ownership journey smoother and more cost-effective.

Taking deliberate actions can help you boost credit score over time, making you eligible for a better loan process.

Conclusion

The process to improve CIBIL score is a vital step toward securing a favorable home loan. It requires time, patience, and consistent financial discipline.

Our CIBIL score guide provides a detailed understanding of how scores are calculated and how you can improve yours.

At Morais City, we believe in making home ownership a reality by offering well-developed residential properties in Trichy’s thriving cosmopolitan township. With competitive rates and excellent amenities, our real estate projects are designed to help you invest in a brighter future.

Curious about finding your dream home? Explore our real estate options crafted to suit your needs, and let’s start this exciting journey together!